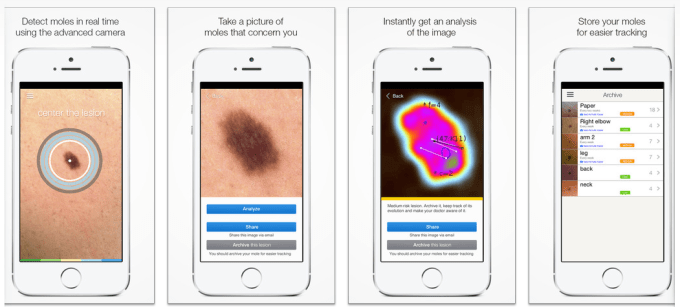

Can an app warn you that you might have skin cancer? Digital health startup SkinVision is using smartphone tech and vision algorithms to allow consumers to track changes to their moles. Users of its iOS and Android apps, which have been downloaded some 200,000 times since launch back in 2011, take a photo of a mole and the app then performs a visual analysis, with the aim of identifying suspicious growths such as melanoma.

“Skin cancer grows chaotically and potential suspicious moles are identified based on signs of non-natural growth,” explains CEO Dick Uyttewaal. “The algorithm within the online assessment reviews signs of non-natural growth of skin lesions and is based on an established mathematical methodology in biology called fractal geometry.

“The algorithm currently looks at seven different criteria and will be further improved based on the continuous growth in our database (currently in excess of 1 million pictures).”

Moles are rated using a simple traffic light system (using a red, orange or green risk rating). The app lets users store photos in multiple folders so they can track different moles over time.

“A changing mole (color, size, symmetry etc.) is a clear sign that something is wrong and that the person should visit a doctor immediately,” he adds.

How accurate is the SkinVision tech at identifying melanoma? Uyttewaal says it’s as good as the “average eye of a dermatologist”, noting also that it’s the only such skin cancer detector app to have obtained CE certification in Europe.

“Medical studies show that the sensitivity of dermatologists to recognize melanoma is 70 to 90 per cent… [A 2014 study of the app, conducted by the university clinic of Ludwig Maximillian University] shows an overall accuracy to recognize melanoma with the red rating of 83 per cent, and a sensitivity to recognize melanoma of 73 per cent (with red rating) and 92 per cent (with red and orange ratings),” says Uyttewaal.

“The study was based on the SkinVision technology that was looked at November 2012, and since the study we have continued to deliver enhancements to the technology,” he adds.

SkinVision is now announcing what a terms a late Series A/early Series B funding round of €3 million ($3.4M), bringing its total raised to date to between €5 million and €6 million. Since the initial app launch, the business has grown into what Uyttewaal terms a “solutions platform”, monetizing its software via different monthly subscription pricing models — which vary depending on the country. Some free usage is possible, although a subscription payment model is its primary monetization channel at this point. (And one which has triggered a rash of negative reviews of its apps.)

“Consumers are only starting to get used to paying for health related applications. For those that provide support in a health risk area, and have been clinically proven, consumers have begun to pay monthly fees in excess of the SkinVision subscription, because they recognise the value and importance of managing potentially risky lesions early to prevent the need for longer term, more invasive and costly treatment,” argues Uyttewaal.

“I would also like to add that SkinVision does not use customer data for commercial purposes,” he adds.

SkinVision’s new tranche of financing comes from European pharmaceutical firm LEO Pharma, whose business unsurprisingly also has a strong focus on dermatology, so there’s obvious synergies to be leveraged there. Also part of the round: prior investor and SkinVision majority shareholder Personal Health Solutions Capital, a Dutch investment firm focusing on consumer-centric digital health solutions.

SkinVision notes specifically that a key impetus for the investment is widening applications for its technology — so applying it to track and assess other serious skin conditions, beyond moles and melanomas. So again, having a pharma company as an investor aligns with its expansion plans.

Commenting on the funding in a statement, LEO Pharma’s SVP of global development, Kim Kjoeller, notes: “The Internet is dramatically changing how consumers manage their health and that creates new opportunities for us to deliver innovative, value-added services. We are very pleased to collaborate with SkinVision, because we will gain unique learnings about the convergence of digital technologies with medical applications.

“The coming years will see an ever changing and increasingly digital health care environment and LEO Pharma wants to be at the forefront of that trend. This is a huge opportunity for the European technology and pharmaceutical industries to become world leaders.”

SkinVision’s new financing will also be used to expand into new geographical markets, and to try to establish stronger ties with national healthcare systems in select markets, adds Uyttewaal.

Comments

Post a Comment