A kerfuffle in Indonesia today illustrated the unpredictable nature of regulators and regulations when it comes to ride-sharing services in Southeast Asia, the region where smartphone ownership is rapidly growing among its collective population of 500 million plus.

Less than a week after Jakarta’s governor Uber, GrabTaxi and other ride-sharing services a set of requirements in order to (finally) operate legally, ending a year of uncertainty around their status, the Indonesian government today banned (and then, less than 12 hours later, unbanned) Go-Jek, a motorbike taxi on-demand service that claims 200,000 drivers in the city, and others in its space.

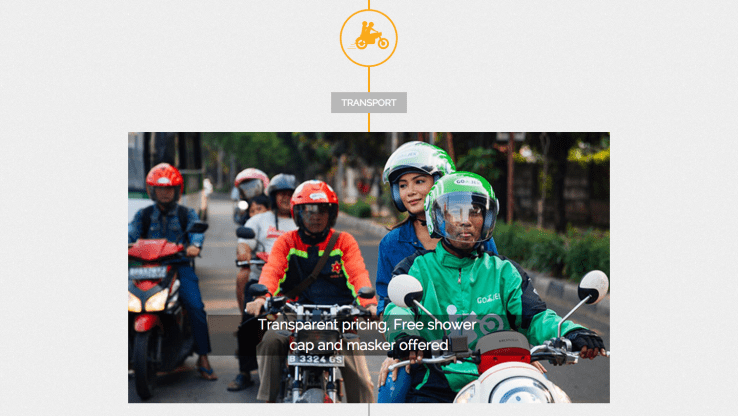

Ojek (motorbike taxi) services Go-Jek, an up-and-coming startup backed by Sequoia that also offers food and package delivery, Uber-rival GrabTaxi’s GrabBike service, female-focused Lady-Jek and Blue-Jek were among those banned by Indonesia’s Ministry of Transport, which held a press event late on Thursday.

“The requirements of public transportation are [that the vehicles] have at least three wheels, have legal standing and possess a public transportation business permit,” The Jakarta Post quoted Transportation Ministry Ignatitus Jonan as saying.

“Whatever the name, the operations similar to Go-Jek, Go-Box, GrabBike, GrabCar, Blue Jek, Lady Jek are all prohibited,” he added.

However, less than half a day later, it was all change. The ban was overturned following outcry on social media, and the intervention of — among others — Indonesian President Joko Widodo, who stated on Twitter that regulations should be supportive rather than restrictive.

The President’s communications team stressed via a statement to Digital News Asia that the industry has grown out of necessity

“We need to remember that ojek exists because the people need it. We need the transportation agency and ministry to support them and at the same time regulate them, to make sure that they follow the safety requirements needed,” its statement read.

Anyone who has ever set foot in Jakarta, a bustling city of more than 10 million people with jam-packed roads, can appreciate the convenience and speed of an ojek. Google recently revealed that Go-Jek was among the top ten most popular search terms in Indonesia this year, and the company is clearly gaining ground among the masses as the collective Facebook and Twitter response to the ban illustrated.

“The president overturned the decision within 12 hours, supporting us publicly,” Go-Jek CEO Nadiem Makarim told TechCrunch. “[The] people backlash on social media was historical, we were the top trending topic for the whole day. The minister of transport retracted the ban, and now we are 100 percent backed by the president to operate.”

GrabTaxi, which operates GrabBike in Jakarta — in addition to Thailand and Vietnam — also went on record which a statement that included the following:

We respect and will comply with local regulations. The ridesharing industry is still in its infancy and we will continue to work with the government and all industry stakeholders to expand the regulatory framework. We believe that it’s our shared objective to make the Indonesian public transportation more efficient, and to enable all Indonesians to commute safely.

There were a few sensational headlines (hello Business Insider!) but, those aside, most watchers won’t be hugely surprised to see a chaotic situation in Southeast Asia caused by different government organizations and regulators trending on each other toes. In the end, though, Go-Jek has come out in a stronger position than it started. That’s much like the cycle for acceptance that Uber and GrabTaxi have entered in the region: going from being unwanted, to popular and then to banned and — as is beginning to happen in countries like Singapore, Indonesia and Philippines — embraced as a legal business. Go-Jek just jumped a lot of those hoops in 12 hours!

Comments

Post a Comment